how to reduce taxable income for high earners australia

The amount of offsets you get from your taxes Having a smaller capital gains tax CGT liability. Vehicle and travel expenses.

How Do Taxes Affect Income Inequality Tax Policy Center

If you are buying your own home you can kill two birds with one stone by shifting savings toward your home loan instead.

. Come in for a review at no cost and see what possible. Another great way to save money on taxes is to salary sacrifice a portion of your pre-tax pay into your super fund. In general you are taxed on your savings because of the interest income you earn on savings so if you are an avid saver you could face a hefty tax bill at the end of each year.

Paying off your mortgage can reduce taxes. Tax Saving Strategies for High-Income Earners. A family trust or a discretionary trust can be a means for them to build wealth if they apply tax-effective financial.

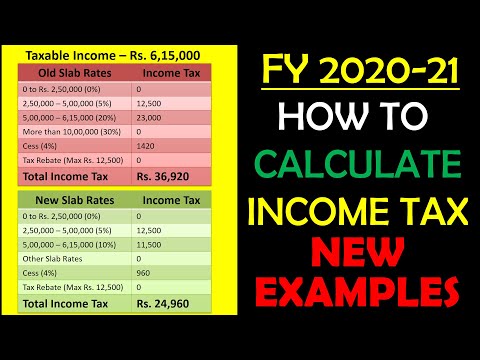

Stephen Kiprillis Taxable income falls into five tax brackets. A discretionary trust would be used for distributing business profits investments. The 11 millionaires who were able to get their taxable income below 6000 donated a total of 158m.

Superannuation contribution options to reduce taxes. How to Reduce Taxable Income Through Charitable Donations. Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO.

Make deductions faster and defer income. Stash a high-income choice like a junk-bond fund in an IRA or 401 k to keep that income off the return youll file next spring. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia.

Put your funds in the right spots. If you are a high-income earner it is sensible to implement tax minimisation strategies. Tax deduction versus tax offset The ATO considers some expenses as valid ways to reduce tax payable however how and when the reduction is applied on the assessable income depends on the type of expense.

Because she stays at home she only has to pay 13500 in taxes. This is also called salary packaging and it works a few. Invest in an investment bond to minimise your taxable income.

So Call us on 0280625961 or Book an Appointment. Investing in these types of accounts ie. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

The taking care of your partners assets. So the money was distributed to Mary. At some point there will be tax consequences associated with the distribution of the assets.

Salary sacrificing super Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. One way to reduce your taxable income is to donate to a DRG organisation. To do this first they declared their total income from multiple sources such as wages bank interest and dividends from shares.

When you make a concessional contribution into your super account however you only pay a 15 tax rate. The amount left was their taxable income. Tax-deferred investment vehicles arent the same as tax-exempt such as a Roth IRA or HSA accounts.

Then they subtracted deductions such as work expenses and charitable donations. By offering qualified retirement plans such as 401 k 405 b or 457 employers may attract employees qualified to invest money in their retirementThose who earn high incomes can minimize taxes with one of. How Can A High Earner Reduce Taxable Income In Australia.

Tax-deferred retirement accounts like 401 ks and 403 bs allow you to save money at your currently high marginal tax rate protect those investments from taxes and creditors as they grow and use account withdrawals in retirement to fill the lower tax brackets. High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits. 6 Tax Strategies for High Net Worth Individuals 1.

Salary sacrifice contributions to super are taxed at a. These penalties can range from fines to imprisonment for more. If for example you earn 70000 and take a 5000 deduction your.

Effective tax planning with a qualified accountanttax specialist can help you to do that. High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice. A DRG deductible gift recipient is an ATO recognised organisation or fund that can receive tax-deductible gifts.

Because his income is so high any extra income will be taxed at the highest rate currently at 465. You are allowed to claim a tax deduction depending on the type of donation. The extra 15 tax imposed under the Division 293 rules is applied because as a high-income earner your marginal tax rate without the 2 Medicare levy for income amounts over 180000 is 45 in 202122.

Negatively gear your investment property to reduce your taxable income. One of the best ways that you can lower your taxable income is through pre-tax retirement contributions. Make spousal contributions to reduce your tax liability.

How To Reduce Taxable Income For High Earners Australia. Consider salary sacrificing to reduce your taxable income. But 21 of the no tax-paying millionaires donated an average of 10099m.

Dont waste your good fortune or hard work by not assessing if you are using the system to your advantage. Hold investments in a discretionary family trust for tax-effective income distribution. Use your brokerage account to hold funds that wont throw off a lot of taxable income such as a municipal-bond fund or a low-turnover stock index fund you expect to hold for years.

The family company also known as a holding company or bucket company is taxed at 30 so thats another 9000. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. Tax deductions you may want to maximize.

What Is Taxable Income With Examples Thestreet

Effective Tax Rate Formula Calculator Excel Template

How Do Taxes Affect Income Inequality Tax Policy Center

Reduce Taxable Income Smart Ways To Save More Money Easi Australia

How Is Taxable Income Calculated

What Are Marriage Penalties And Bonuses Tax Policy Center

Worried About Taxes Going Up 9 Ways To Reduce Tax

How Do Taxes Affect Income Inequality Tax Policy Center

Progressive Tax Definition Taxedu Tax Foundation

What Is Taxable Income And How To Calculate It Forbes Advisor

How Do Taxes Affect Income Inequality Tax Policy Center

How Is Taxable Income Calculated

5 Ways To Avoid Bumping Your Income Into A Higher Tax Bracket Taxact Blog

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Good Morning Taxable Income Earners Everyone Wants To Reduce Their Tax Right So One Simple Way To Determine If You Ca Virtual Assistant Income Tax Deductions

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Contribution Of Top Ten Percent Earners To National Income Spain 2021 Statista